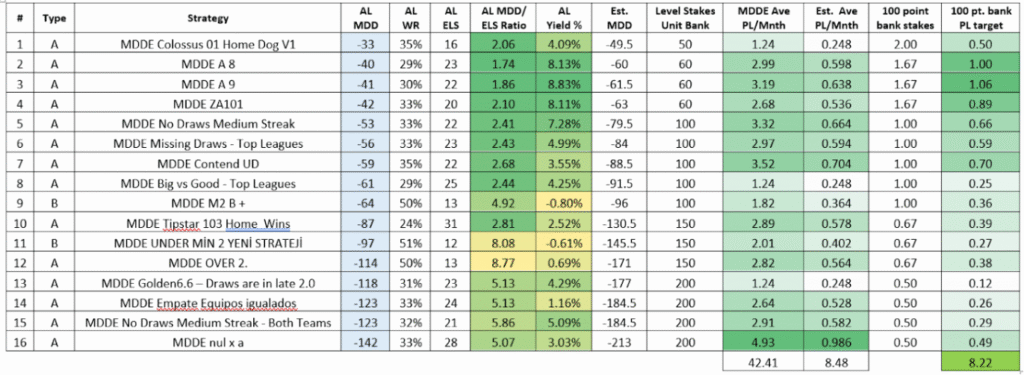

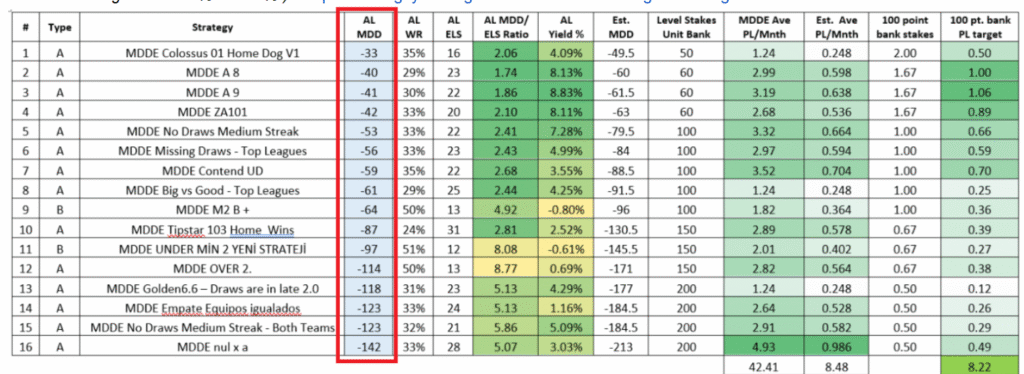

The combined MDD of the AL versions is -1,340 units. That would be a very unusual worst case scenario if all the strategies went beyond their AL MDDS. We cannot base our banks on that number. It would be a completely inefficient use of the bank and would not cover costs.

“For unit bank planning, calculate the estimated MDD as maximum 150% of the All Leagues MDD. (Average MDD is 50% of the AL MDD. The range is from 8% to 135% ) “

If average MDD is 50% of the AL MDD, then is -670 units the average MDD for this set? But again that is if all 16 strategies have their statistically average worst losing run at the same time. Again this would be an inefficient number to base the starting bank on.

If we calculate another way, the average AL MDD of these strategies would be 1340/16 = 83.

If we then take +150% of that average MDD as our starting bank size we get 125 units, which is very close to your starting 120 unit bank.

So again, I do think a 120 unit bank seems like a very fair size to start with. It does not cover the worst case scenarios, but if we did that, then we would be inefficient with our betting bank in my opinion.

So where to go from here.

Now, what is the best course of action?

1) Continue as we are and hope the trend will finally revert

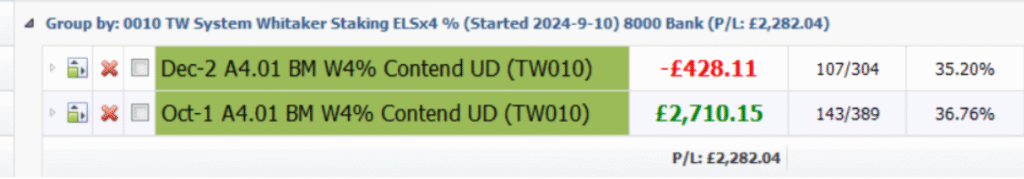

This is what I am going to do. I am going to let the bots keep running as they are, but with Whitaker staking in my case.

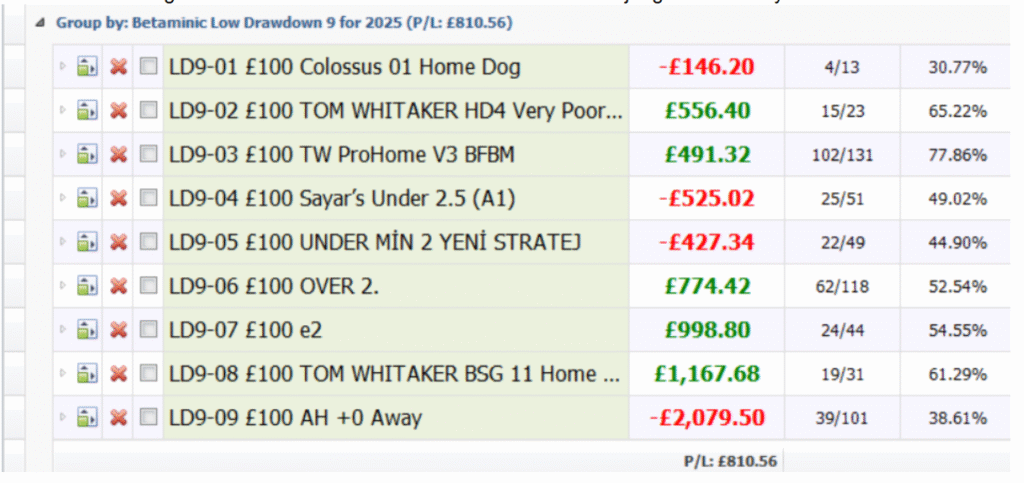

2) Change the strategy set and build up more stable system – something like less draw strategies, more lower odd strategies like user enthususername suggested

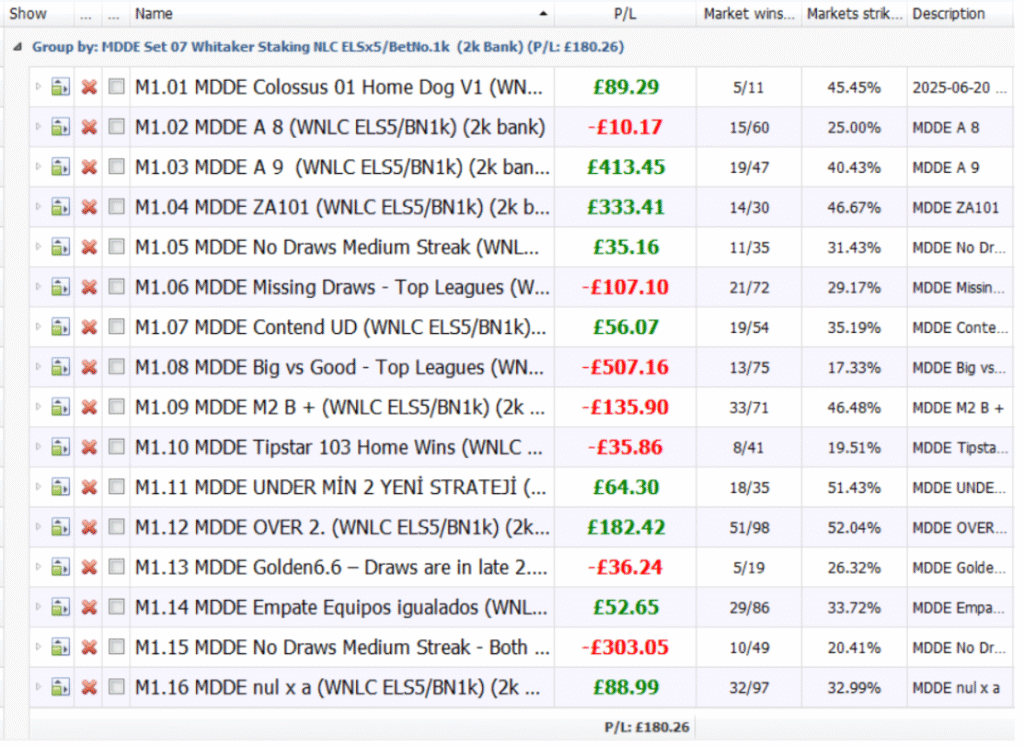

This MDDE set is meant to be a stable set but we have indeed hit a big combined losing run of the strategies together.

For me, I am using Whitaker staking, so the draw bets just stake about 1% of the bank each time.

I feel (gut feeling) that the draw bet tends to naturally have more value since it is an unpopular bet. Casual bettors prefer picking winners, and I think that it is easier to find value in draw strategies.

So I am not sure that removing them makes it a more stable system. (But I could be wrong.)

By stable, with level stakes, do we mean trying to reduce natural volatility of higher odds ranges and longer losing runs? Then looking at dropping the lower win rate / higher odds strategies would be the way to do that. But I would worry we miss out on value there.

I would recommend switching to odds-adjusted Whitaker Staking instead of giving up those higher odds strategies.

3) leave the things as they are and on weekend place bets with lower DD strategies priority (as you suggested)

This is a very valid option for level stakes.

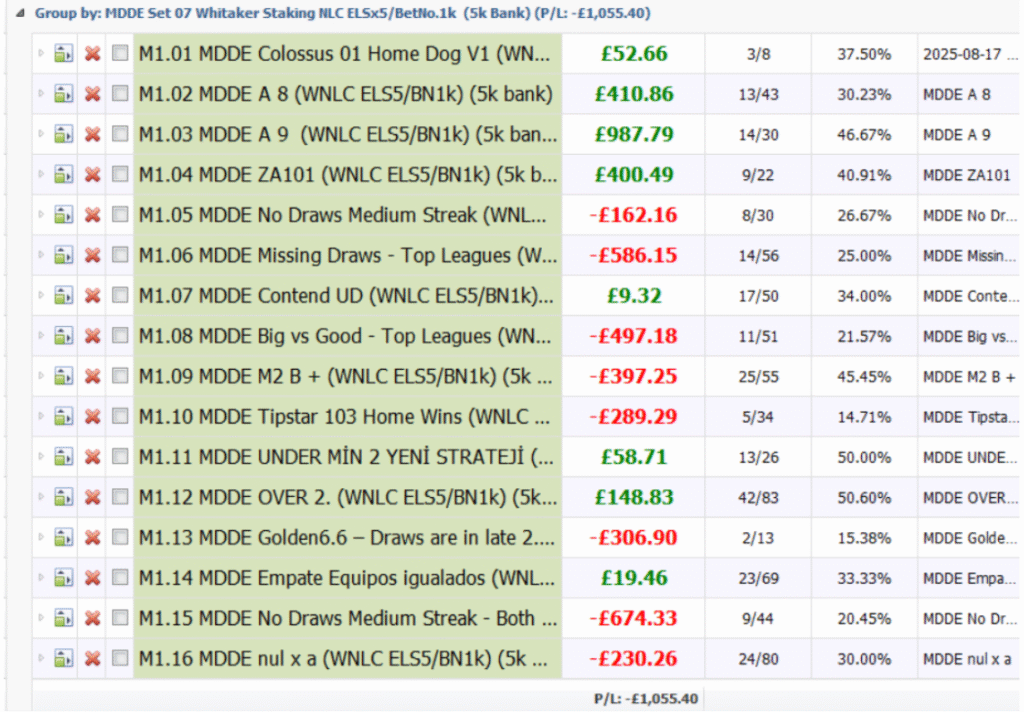

You could cut out a few of the higher AL MDD strategies 13-16 in the set.

Note that OVER 2. is a 50% win rate evens strategy, but has a higher AL MDD than 3 of the other draw strategies in the set.

(If you were to change to Whitaker staking, then higher odds strategies don’t matter so much since the staking plan normalizes stakes for odds levels.)

If you stick with level stakes, then dropping the higher AL MDD strategies might be one option.

3) give up and accept the fail of this pathI don’t think this path is a failure. You are doing everything right in using statistics in gambling.

We have backtested the strategies.

We have backtested the research methods used to make the current updated versions of the already working and proven original strategies.

You have started with a healthy sized bank of 120 units.

If the plan is to let the bank run until it hits -120 units or reaches the profit target (+8 units average per month, so about +96 units after 12 months.), then let the plan continue to its pre-planned exit & review points.

We will hit these losing runs, and this is where many people give up. And that is completely understandable.

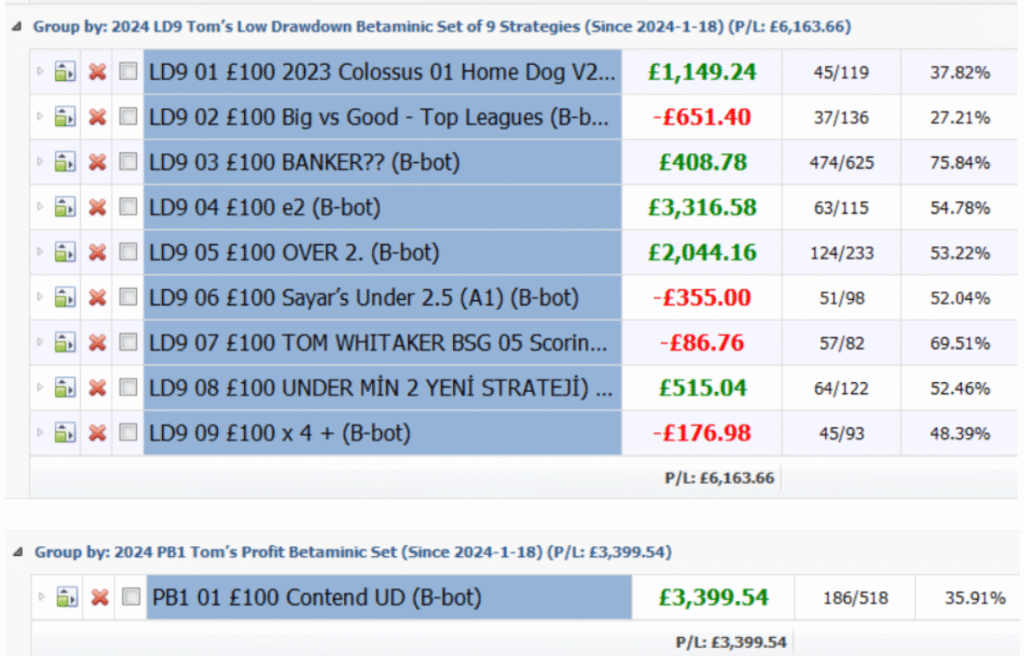

The live bets show that sticking with plans long term is the right method.

I would really recommend switching to Whitaker Staking, and using your nominal bank on that. This would allow you to keep all 16 strategies going, and it would naturally bet less on the higher odds picks, whatever the strategy.

Bf Bot Manager would allow you to automate this, so I also really recommend that.

But if you stay with level stakes,

I would really recommend hanging on longer, and letting it run until it hits the end or recovers.

Or if you have lost confidence and want to reduce risk and leave it with the current remaining bank, then cut out a few of the higher AL MDD strategies 13-16 in the set.

I think the strategies do work long term, but it is the bank management side that needs judgment.

And is it that balance between how much we allot to the system and for what profit target.

For example, for a target +8 units profit per month on average over 12 months: (+96 units in 12 months)

Do we prepare for the worst possible drawdown of all strategies reaching their historical lows again at the same time? 1,340 unit bank for +96 units?

Do we prepare for the worst drawdown of one of the strategies in the group? -142 unit bank for +96 units?

Do we prepare for the average worst drawdown of the strategies? -83 unit bank for +96 units?

Do we prepare for the average worst drawdown x150%? -125 unit bank for +96 units?

This is the current unsure area where our judgment comes into play.

For +96 units target profit, I would be willing to risk a 100 unit bank over 12 months.

So this is probably the most long winded and statistically backed way to say “keep going as you are” and follow your plan to its pre-planned exit & review points.

Best regards,

Tom Whitaker